Nuclear Finance: US Groups Send Letter to Japan Government

Press Release

August 11, 2010

“Beware of Investing in New US Nukes”

Visiting Expert Warns Japanese Government

Tuesday, August 11 (Tokyo): US nuclear expert Kevin Kamps, who is currently visiting Japan, today sent a letter to the Japanese Government warning them to “carefully consider” the “very serious financial risks” of investing in new atomic reactors in the United States. The letter, which was endorsed by over 70 US NGOs, was addressed to Prime Minister Naoto Kan, Minister of Finance Yoshihiko Noda and Minister of Economy, Trade and Industry Masayuki Naoshima.

Kamps is a member of US NGO Beyond Nuclear. He campaigns on a wide range of nuclear issues, including radioactive waste and US Government funding for new nuclear reactors.

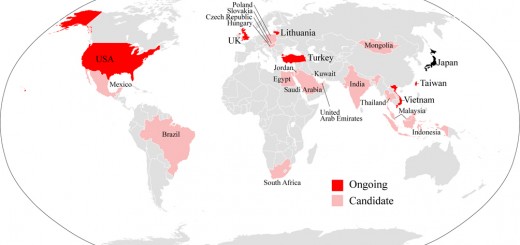

Japanese government and industry hope to export nuclear reactors to countries in Asia, including Vietnam, and to countries in the Middle East, but their first priority is to participate in the construction of proposed new reactors in the United States. However, Kamps points out that the long-awaited US nuclear renaissance might not materialize.

The last order for a new reactor to actually be built was placed in October 1973. To rescue the moribund nuclear industry, the US government is offering various incentives, including loan guarantees, which shift the risk from investors to taxpayers. This means that if companies which receive loan guarantees default on their payments, the government will pick up the tab. The U.S. Congressional Budget Office (CBO) has predicted that over half of new reactor project will default, based upon the past history of the nuclear power industry.

So far, the Nuclear Regulatory Commission (NRC) has received applications to build 26 new nuclear reactors, all of which are so-called “third generation” designs, although the “new” designs are not significantly innovative compared to currently operating reactors. But, as Kamps points out, “None of these applications has been approved by the NRC yet. Until they receive a Construction and Operating License (COL) they cannot receive a loan guarantee.”

In February this year, President Obama announced the first loan guarantee for two proposed reactors (AP1000 – AP stands for “Advanced Passive”) at Southern Company’s Vogtle nuclear power station in Georgia. However, the Westinghouse (owned by Toshiba) AP1000 design being considered has not even received a final NRC design certification. NRC cannot approve a COL until the design is certified, so the loan guarantee cannot be finalized.

Kamps says, “The fact that loan guarantees are being announced before designs are approved and licenses issued shows that the whole program is in a state of confusion.”

Most of the proposed reactors have Japanese involvement, but the most direct involvement is in two proposed ABWRs (General Electric-Hitachi “Advanced Boiling Water Reactors”) at the South Texas Project nuclear power station. Toshiba and Tokyo Electric Power Company have both invested in Nuclear Innovation North America (NINA), which plans to build the reactors.

NINA hopes that the involvement of Japanese companies will enable it to win support from the Japan Bank of International Cooperation (JBIC) and Nippon Export and Investment Insurance (NEXI). However the project is in deep trouble due to escalating costs and delays in the announcement of loan guarantees. NINA’s owners, NRG Energy and Toshiba, recently announced that they are paring back spending on the proposed plant expansion because of uncertainty surrounding a federal loan guarantee for the project. (See notes attached to the NGO letter for more information about this and other projects.)

U.S. federal taxpayer loan guarantees would cover up to 80% of project costs. New reactor proponents could seek the remaining 20% of financing from Japanese government agencies.

The Japanese Government’s New Growth Strategy proposes an expansion in the range of NEXI’s export and investment insurance to cover the risk of policy changes by the government of the importing country and in an interview with the Asahi Shimbun the Minister for Economy, Trade and Industry Masayuki Naoshima proposed using pension funds as a source of long-term investment finance for nuclear export projects (Asahi Globe, August 2, 2010).

However, when Kamps visited JBIC and NEXI on August 4, he warned them, “It is dangerous to view nuclear projects in the United States as less risky than in developing countries. If you want to invest, it would be wiser to invest in highly competitive renewable energy and energy efficiency projects.”

Contacts in Japan

Philip White, Citizens’ Nuclear Information Center, Tel: 03-3357-3800

Aileen Mioko Smith, Green Action, Tel: 075-701-7223

Noriko Shimizu, FoE Japan, Tel: 03-6907-7217

Contact in the US

Kevin Kamps, Beyond Nuclear, Tel: 301-270-2209

References

1. Click here for copy of the US NGO letter

2. Click her for a list of endorsements

3. Background Notes on Financial Risk (pdf file 120 KB)