Commentary: Why wasn’t TEPCO bankrupted?

The nuclear accident at Tokyo Electric Power Company’s (TEPCO’s) Fukushima Daiichi Nuclear Power Station (FDNPS) has left TEPCO under a huge pile of debt. At the time, there were arguments in favor of dissolving TEPCO, the liable party, but due to the Japanese government’s generous support, the company continues to exist to this day. In this article, we attempt to throw light on the reasons why TEPCO was not bankrupted.

Japan’s Act on Compensation for Nuclear Damage states in Section 3, “Where nuclear damage is caused as a result of reactor operation etc. during such operation, the nuclear operator who is engaged in the reactor operation etc. on this occasion shall be liable for the damage, except in the case where the damage is caused by a grave natural disaster of an exceptional character or by an insurrection.” In Section 4, the Act stipulates that “Where nuclear damage is covered by the preceding section, no person other than the nuclear operator who is liable for the damage pursuant to the preceding section shall be liable for the damage.” Thus while imposing on the nuclear power operator unlimited no-fault liability with liability concentrated in its hands, it also provides exemptions in the form of “a grave natural disaster of an exceptional character or by an insurrection.” At the same time, Section 16 provides for necessary government assistance to pay compensation, and Section 17 states that in the case of “a grave natural disaster of an exceptional character or by an insurrection” the government “shall take necessary measures to relieve victims and to prevent the damage from spreading.”

What became a problem at the time of the FNDPS accident was whether or not it had occurred due to a grave natural disaster of an exceptional character. From the outset, the government indicated the stance of not applying the exemption, stating, “As the nuclear power operator, TEPCO should bear liability for damage caused by this nuclear power plant accident.” TEPCO insisted that the accident was due to “a grave natural disaster of an exceptional character” and that “there is a margin for judging that an exemption be invoked,” but eventually accepted liability.

TEPCO’s cash and deposits as the accounts were closed at the end of the third quarter of 2010 (December 31, 2010) were 366.5 billion yen. With company bond redemptions of 500 billion yen coming up in FY2011 and the need to procure fuel worth 800 billion yen, financing from the market was fraught with difficulties after the FNDPS nuclear accident, bringing TEPCO close to bankruptcy.

TEPCO’s cash and deposits leaped up to 2.2 trillion yen at the close of accounts for FY2010 (March 31, 2011). This was almost all in long-term loans. According to news reports at the time, 1.865 trillion yen was provided in loans of three to ten years, with no warranty and at the same interest as before the accident, by eight financial institutions, including the Sumitomo Mitsui Banking Corporation (600 billion yen), the Mizuho Corporate Bank (500 billion yen) and the Mitsubishi UFJ Bank (300 billion yen). It is said that in the background to this was the statement by the then deputy minister of the Ministry for the Economy, Trade and Industry (METI), Kazuo Matsunaga, that “We must also not shirk responsibility. I would also like to see support from financial institutions.”

TEPCO thus managed to overcome the problems of March 2011, but even after that, arguments insisting that TEPCO be declared bankrupt and go into legal liquidation continued. However, in the end, it was decided to allow the company to survive from the viewpoint that if TEPCO went into legal liquidation compensation to those affected by the nuclear accident would be delayed.

Especially problematical were the electric power bonds issued by TEPCO. The Electricity Business Act allows TEPCO and the other power business operators to issue company bonds with “general collateral” that make it possible to prioritize debt repayment to other creditors. In other words, if a company goes bankrupt, those financial institutions that originally stood to make profits from the purchase of the company bonds would receive first priority in debt repayment, whereas compensation for those affected by the nuclear accident would be on the same pecking order as repayment for other debts (e.g. loans, etc.).

TEPCO’s net assets as of March 31, 2011 were 1.6024 trillion yen. It was clear that the estimate for compensation at the time of 4.5 trillion yen would put TEPCO in a situation of net capital deficiency. The balance of company debt at this time was 4.4251 trillion yen. If TEPCO were to be declared bankrupt at that time, the company debt would first have to be repaid, after which other debts, including the liabilities to those affected by the nuclear accident, would be paid out.

There was also the option of allowing TEPCO to go bankrupt, and having discharged the debts the government would, in a separate deal, then pay out compensation from the national treasury to those affected by the nuclear accident. However, since the accident was still ongoing, liquidating TEPCO might pose obstacles to the work of the post-accident clean-up. Considering this, it is not unreasonable that the government at the time decided to allow TEPCO to continue to exist. However, by allowing TEPCO to survive, the stockholders who had invested in TEPCO and the financial institutions that had provided funds, i.e. the investors who bore a certain risk for the sake of profits, suffered no losses, and in their place the greater population of Japan overall would take on the burden. That was how the current TEPCO survival scheme was born.

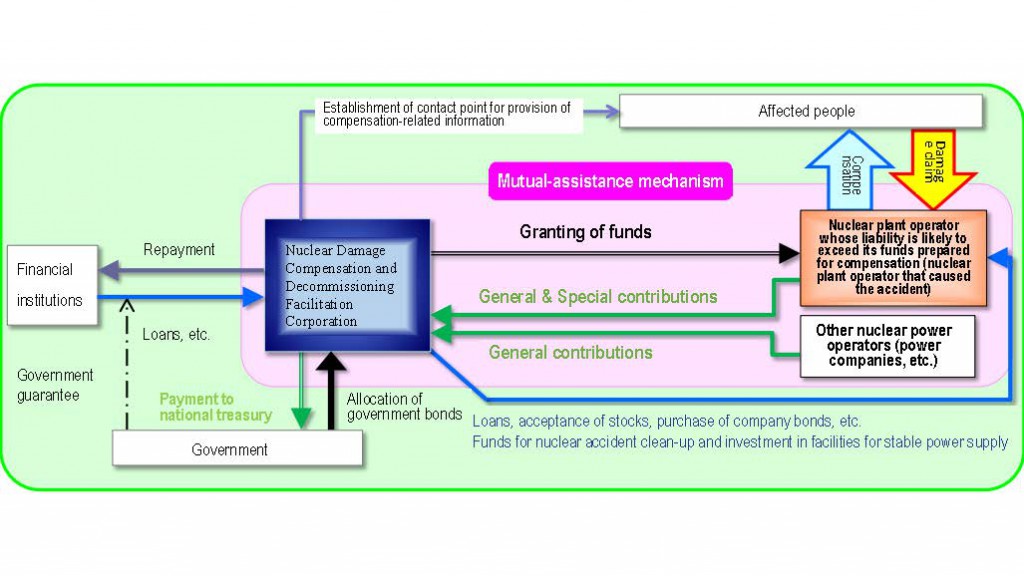

In August 2011, the government enacted the Nuclear Damage Compensation Facilitation Corporation Act to avoid a TEPCO bankruptcy. The scheme inherent in the act is as follows:

1) The government shall establish the Nuclear Damage Compensation Facilitation Corporation (later reorganized as the Nuclear Damage Compensation and Decommissioning Facilitation Corporation in August 2014) as the facilitating organization handling compensation payments and so on in the case of nuclear damage, and nuclear power operators are to establish a reserve fund (general contributions) to provide compensation.

2) The Corporation shall levy a special contribution from the nuclear operator that caused the accident (in this case TEPCO).

3) The Corporation shall provide financial facilitation (granting of funds, acceptance of stocks, loans, purchase of company bonds, etc.) when the Corporation’s facilitation is required for compensation by the nuclear operator. To procure the funds necessary for financial facilitation, the Corporation can issue government-guaranteed compensation bonds to borrow money from financial institutions.

4) In the case that special support is required from the government, the Corporation and the nuclear operator shall determine the amount of compensation, prepare a “special business plan” that sets out the content and value of the financial support, policies for business management rationalization and so on, and receive approval from the relevant ministers (the Cabinet Office and METI). Following approval, the government will allocate government bonds to the Corporation, the necessary funds then being granted to the nuclear operator by the Corporation.

5) The Corporation shall pay into the national treasury money up to the amount of redemption of the government bonds.

Of this, it is presumed that the 4 trillion yen estimated for decontamination costs will be eventually supplemented by profits accruing from the sale of TEPCO stocks, the 1.6 trillion yen costs for intermediate storage facilities will be paid from the national treasury, and that 3.7 trillion yen of the total compensations will be paid by nuclear power operators from the general contributions, while 0.24 trillion yen will be borne by imposing a power distribution consignment charge on power companies that have entered the market recently due to deregulation of the power market.