Fukushima Now Part 1: The Fourth Comprehensive Special Business Plan ~Apple Pie in the Sky

By Ban Hideyuki (CNIC Co-Director)

On July 21, Tokyo Electric Power Company Holdings (TEPCO HD) applied to the Ministry of Economy, Trade and Industry and Minister of State for Nuclear Damage Compensation and Decommissioning Assistance, Kajiyama Hiroshi, for approval of their 4th Comprehensive Special Business Plan (4CSBP) and received approval for it on August 4. Four years on from the previous “New-New Comprehensive Special Business Plan” (NNCSBP) (2017), the new revisions of the 4CSBP examined mainly nuclear power generation.

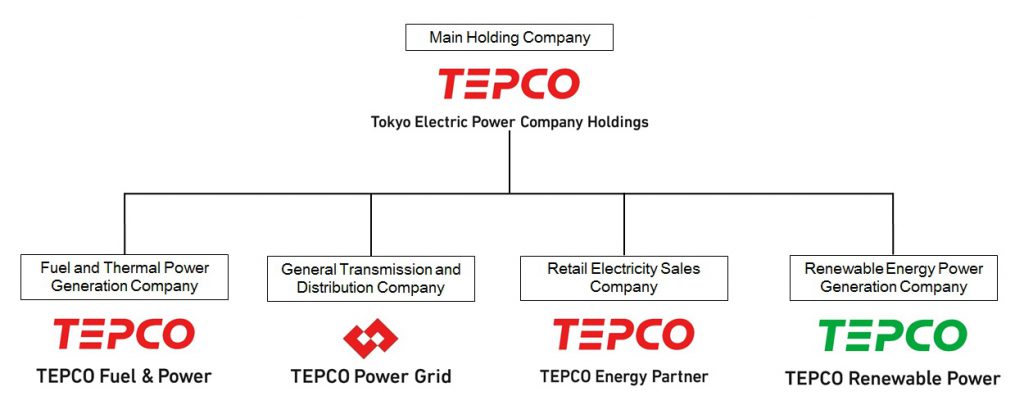

A vast group of subsidiary companies

The former Tokyo Electric Power Company (TEPCO) shifted to a holding company system in April 2016 when the system to split power generation and power distribution was introduced. Under the holding company TEPCO HD, the power generation division was spun off to TEPCO Fuel & Power, the transmission and distribution division to TEPCO Power Grid, the retail division to TEPCO Energy Partner, and the renewable energy division was spun off from the power generation division as TEPCO Renewable Power. The nuclear power plants belong to TEPCO HD.

According to the company’s annual securities report for fiscal 2020, it has a further 36 consolidated subsidiaries and 28 affiliates with 20% or more of voting rights. The latter includes Japan Nuclear Fuel Limited (29.7% voting rights) and Japan Atomic Power Company (28.3% voting rights). Further, all presidents of Japan Nuclear Fuel have come originally from TEPCO. Given the mismanagement at nuclear power plants to date, it is unlikely that TEPCO HD’s governance of this vast agglomeration of subsidiaries will not be all that effective.

Environmental changes since NNCSBP

4CSBP regards environmental changes as being carbon neutral by 2050, but this will not be discussed here. As another environmental change, the report describes unauthorized access and the problems of failure and neglect of intrusion prevention devices at Kashiwazaki-Kariwa Nuclear Power Station (KKNPS) as “a series of inappropriate incidents that seriously undermined trust in society and local communities.” 4CSBP mentions these two cases, but there are also other cases, such as the issuing of a completion report in spite of the construction of additional safety measures being incomplete and improper welding of fire extinguishing piping revealed by a whistle-blower. In 2003, all of TEPCO’s nuclear power plants had to be shut down to conduct safety checks due to cover-ups of nuclear power plant problems discovered in 2002. While restoring trust is the top priority, we can say that this has been impossible since 2002, when trust was irrevocably lost. The only path that remains is the closure of all reactors.

Counting unhatched chickens

Despite this situation, resumption of operation of KKNPS Unit 7 is envisioned in FY2022, Unit 6 in FY2024, and an additional unspecified unit in FY2028. Earnings are estimated assuming a profit of 50 billion yen per unit per year, and assuming that the restart of the reactors might not take place until 2023 or later. Since NNCSBP assumed the restart of 4 reactors and dreamed that if things went well all of them would be restarted, it may be that TEPCO HD is imagining restarts after 2030. TEPCO HD hopes to secure around 200 billion yen a year in damage compensation, around 300 billion yen a year in funds for the decommissioning of Fukushima Daiichi Nuclear Power Station, as well as earning roughly 450 billion yen a year in recurring profits. As the forecast is based on consolidated financial results, TEPCO is also banking on profits accrued by subsidiaries. One of these, Japan Nuclear Fuel, was supposed to have reached this state in FY2027 in NNCSBP, but 4CSBP now expects it to be in FY2030 or later. It should be said that it is not possible to fulfill a business plan that depends on nuclear power.

The three unfulfilled pledges

TEPCO HD’s pledges are: (1) to pay compensation to the very last person, (2) to ensure prompt and detailed compensation, and (3) to respect mediated settlement proposals. The rejection of the proposal mediated by the Alternative Dispute Resolution (ADR) and the reality of the trial clearly show that none of these pledges are being fulfilled.