The Capacity Market: An overview and issues

By Matsukubo Hajime (CNIC)

The reform of the Japanese electric power system, including the deregulation of electric power retailing and the separation of power generation and transmission, occasioned the creation of several new markets. One of these, the capacity market, when looking at examples from other countries, has effectively metamorphized into a subsidy for nuclear and coal-fired generating plants. With the market design as it is currently being considered, the size of the capacity market will likely be around 1.4 trillion yen, which will finally be levied from electricity bills.

Background

Until the reform of the electric power system, the generation, transmission and distribution, and retail of Japan’s electrical power was almost totally monopolized by the former ten regional “general power companies,” including the well-known Tokyo Electric Power Company (TEPCO) and Kansai Electric Power Company (KEPCO). These are the “former general power companies” (below, “FGPCs”). However, due to calls demanding a more diverse electricity supply, the government gave cabinet approval to the “Policy on Reform of the Electricity System” in 2013. The aims of the “Policy” included complete deregulation of electric power retailing and the separation (“unbundling”) of electricity generation and transmission.

The government then pursued electricity system reform based on this cabinet approval, complete deregulation of electric power retailing being achieved in 2016 and legal unbundling of the power transmission and distribution sector to take place in 2020. As a result, the share of marketed electric power held by power companies that were new entrants into the market (“new power companies”) expanded from 5.2% before deregulation to 14.3% in October 2018.

Expansion of the share of the new power companies means that the FGPC share shrank. Since the FGPCs own around 80% of the total installed generating capacity, from the viewpoint of the FGPCs, they now hold surplus generating capacity. In this case, they have two main options. One is to shut down or decommission surplus power plants, and the other is to sell the surplus power on the wholesale electricity market and reap the profit from the sale of the electricity.

Electric Power System Reform and the Risk of Power Supply Shortages

In normal commercial operations, there would be no obstacle to shutting down or decommissioning a power plant which could not be run at a profit, but there are cases with electricity when that should not be done. The reason is that if the demand and supply of electricity are not balanced then there is a risk of large-scale blackouts occurring. Especially problematic is how to maintain supply in the face of demand peaks, which may occur several times each year, and when there is a large-scale blackout due to sudden power plant outages, as happened during the TEPCO Fukushima Daiichi Nuclear Power Station accident in 2011 and the Hokkaido Eastern Iburi Earthquake in 2018. Under the former regional monopoly system, the Electricity Business Act compelled FGPCs to supply power in such cases. For this reason, FGPCs maintained power supply facilities, such as unprofitable power plants (e.g. oil-fired power plants) or ageing plants, to meet this demand.

Since deregulation of the electric power system, however, this compulsory supply is no longer imposed on FGPCs but on retail electricity businesses. Seen from the viewpoint of the power generation side, if there is no requirement to maintain capacity in excess of the demand that it is obligated to supply, for instance through one-on-one contracts with other businesses, then it has the option of shutting down or decommissioning unprofitable power plants. If these plants are closed down without substitute facilities being made available, there will be a high risk of capacity shortages occurring at times of peak demand or supply emergency, etc.

Expansion of Renewable Energy, Power Demand Reduction and the Risk of Power Supply Shortages

At the same time, issues have also appeared in the selling of surplus electricity on the wholesale electricity market due to the rapid expansion of electricity generation by renewable energy sources (“renewables”).

In general, the construction of power plants entails huge costs. However, since fixed costs such as construction costs have already been invested, the decision about whether or not to generate electricity is not based on a consideration of the overall costs but on whether the short-run marginal cost (SRMC) (e.g. the increase in overall power generation costs when an output of 1kW is maintained for 1 hour, these costs being mainly fuel and maintenance, including labor, costs) is low and whether the electricity can be sold at a price exceeding the SRMC on the wholesale electricity market. For the electricity generating business, the differential in the wholesale electricity market price and the SRMC is the profit it stands to make. Furthermore, the generating systems with the lowest SRMC are the renewables, solar and wind power, whose fuel costs are zero.

Provided demand is unchanging, when large amounts of this kind of cheap electricity become available, the wholesale electricity market price will naturally fall. Electricity generating businesses that have been selling their electricity on the wholesale electricity market will no longer do so when the SRMC of generation exceeds the wholesale electricity market price. Even if they are able to sell their electricity, since the market price is falling, their profits will be reduced.

For instance, in the Kyushu Power Company and Shikoku Power Company (both FGPCs) regions, cases have arisen where in certain time zones roughly 80% of the total supplied electricity was derived from solar or wind power. In time zones when power cannot be generated from solar power facilities, this large supply of cheap electricity does not occur. Thus, when considering the overall system, due to the introduction of renewables, revenue from the sale of electricity on the wholesale electricity market declines to the extent that time zones occur when there is low-priced electricity available. In addition, since the TEPCO Daiichi Nuclear Power Station accident, there have also been efforts made to conserve energy, causing demand itself to show a significant reduction. As a result of this expansion of renewables and demand reduction, profits have fallen and the maintenance of unprofitable power supply facilities has become a major burden on electricity generating businesses.

Further, in the case of the construction of a new power plant, when the wholesale electricity market price converges on the SRMC, there is the possibility that the huge initial investment in plant construction cannot be recovered. Therefore, for an existing power plant, since the investment has already been made, the decision to operate the plant can be made on the basis of the SRMC, but to construct a new power plant it is necessary to have a fairly long-term outlook for the selling price of the electricity. However, it will be very difficult for an electricity generating business to construct a new plant if that price is simply fluctuating around the SRMC.

What a Capacity Shortage will Bring About

A customer exodus from FGPCs occurred as a result of the deregulation of the electric power system. In addition, a situation is also arising where the price of electric power is falling due to the expansion of renewables and a decline in the demand for electric power. This will result in a structure where it would be better for electricity generating businesses that hold surplus power plants to cut costs by shutting down or decommissioning high-cost power plants in order to improve earnings.

What will happen if there are fewer power plants? For instance, at peak power demand or if power plants stop due to some kind of trouble, there is a high risk of blackouts occurring due to a power supply shortage. It is also thought that the price of electricity could rise due to a decline in the amount of electricity that generating businesses want to sell on the wholesale electricity market.

If the price of electricity is high, it becomes possible to construct new power plants, but in the case of the construction of, for example, coal-fired or LNG-fired power plants, a lead time of around ten years is necessary. The result of this could be that in the case of thinking about power plant construction in the situation where the number of power plants has dwindled and the trend in the price of electricity is to remain high, it is possible that this price trend will remain unchanged over a period of about ten years.

Capacity Mechanism and the Capacity Market

Given the situation noted above, a variety of means of securing power plants has been introduced in countries where the deregulation of the electrical power system is under way in order to ensure adequacy (adequate capacity for a stable power supply). In Scandinavia and Germany, for instance, power facilities are first secured by competitive bid, and adequacy is ensured by means of a “strategic reserve capacity” that will supply power by starting up these facilities in times of emergency. Japan has adopted the capacity market and this is set to begin transactions in 2020. It is basically the same as that introduced in the UK and by PJM, the USA’s largest regional transmission organization (RTO – an organization which operates and manages the power grid over an extensive region, and which is independent of power companies, etc.).

The following is an overview of the capacity market that is to be introduced in Japan.

1. What will be Transacted on the Capacity Market?

The capacity market will deal not in electricity as measured in kWh, but in electricity generating capacity as measured by kW. For hydropower, thermal and nuclear power, total power generation minus power consumed inside the power plant, etc. is recognized as the capacity. For variable power supply facilities such as solar power or wind power, capacity is calculated as the average of the lowest five days of power generation output at a designated time of day during the average of the maximum three days’ demand in the last 20 years. (I.e. of the 60 data points – 3 × 20 – representing the three days of maximum demand over the past 20 years, the average of the five lowest days of power generation output is taken as the generating capacity of the facility.)

2. The Capacity Market’s Buyers, Sellers and Cost Burden

The capacity market’s sellers are the electricity generation businesses that own power plants. The types of power supply facilities that can participate in the market are all facilities except those that are receiving subsidies as feed-in tariff (FIT) facilities. Sellers are also able to either opt to participate or not for each power supply facility. The buyer is the Organization for Cross-regional Coordination of Transmission Operators (OCCTO), which was established during the reform of the electric power system. The purchasing costs are funded according to rate of usage of each electric power retail business at the time of the annual peak capacity, power transmission and distribution businesses also taking on a part of the burden. These costs will be charged to the final consumer as electricity and wheeling charges. (Wheeling refers to the transportation of electricity between different grid systems.)

3. How Prices are Determined

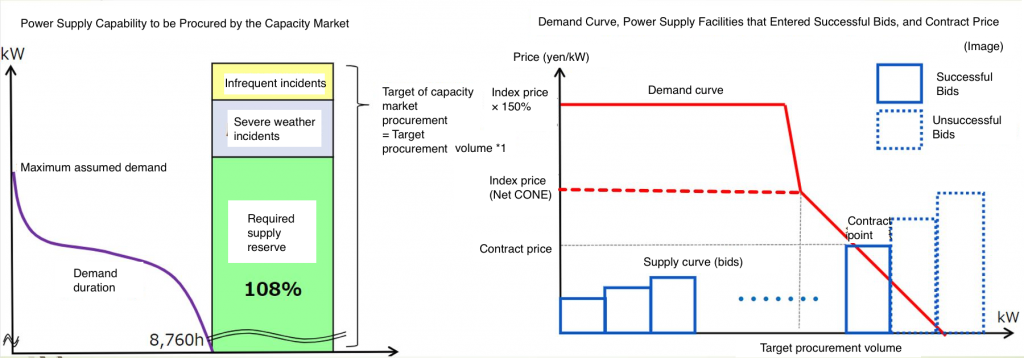

The purchase price is determined by competitive bid. OCCTO determines the capacity necessary for the country as a whole for one year and four years following the year in which transactions take place. Having done that, among others, it sets a rough target price, Net-CONE – Net Cost of New Entry – the price per kW to recover the investment cost for construction of a new power plant within a certain period of time minus revenue from the wholesale electricity market. These conditions are then brought together to establish the demand curve. The sellers, the electricity generation businesses, then determine their bidding prices for each power supply facility and enter their bids. The contract price is defined as the point where the accumulated bids intersect with the demand curve (see figure).

The initiation of transactions for the capacity market currently under consideration is 2020, the transactions being for 2024. The Net CONE price is considered to be a new LNG-fired power plant with a recovery time for investment of 40 years, this being 9,307 yen/kW at present. If this were to be the contract price, then, as an example, the Tokai No.2 nuclear power plant at an installed capacity of 1056 MW (net output) would receive around 9.8 billion yen from the capacity market.

The required capacity for the whole country is considered to be the annual peak power demand to which is added a reserve amount in preparation for power supply facility outages. This value is predicted to be around 150 million kW (150,000 MW). While it would depend on the contract price, if this is set at 9,307 yen/kW, the scale of the market would reach 1.4 trillion yen (150 million kW × 9,307 yen). Dividing this figure by the total for retailed electricity in 2017, 863.2 billion kWh, gives a price per kWh of around 1.62 yen. Converting this to the monthly average domestic power consumption of 400 to 500 kWh results in an increased burden on a household of 648 to 810 yen/month.

Figure: Power Supply Procured by the Capacity Market (left) and Method of Determination of the Contract Price (right)

Many Issues

A careful check of the UK and US capacity markets reveals that existing power supply facilities make up the vast majority of the successful bids. If we think about it, we can see that this is an obvious consequence of the bidding strategy of electricity generating businesses on the capacity market.

Newly constructed power supply facilities will bid at a price where they can basically recover their invested funds (in most cases this will be the Net CONE price). In this case, fixed costs are recovered on the capacity market and the recovery of generating costs and profit will be gained from the sale of electricity on the wholesale electricity market and elsewhere. At the same time, existing power supply facilities that are already running will be operated whether there is a capacity market or not. Because they do not care about the capacity price of successful bids, they enter a bid of 0 yen. Further, it is the contract price on the capacity market that is the deciding factor when considering whether to generate electricity or decommission an existing power supply facility. Because of this, generating businesses will bid the amount for the costs necessary to maintain operation of a power plant minus revenue to be gained on the wholesale electricity market and elsewhere.

Thus, the system design of the capacity market lends strong support to the operation of existing power supply facilities, as far as possible, rather than to the construction of new power plants. Rephrased, this means that however decrepit or however much CO2 is emitted from a power plant, this is a market that promotes the notion that it is beneficial to operate a plant provided the marginal cost is low. In fact, on the UK capacity market, nuclear power plants, coal-fired and LNG-fired power plants are successful bidders, while new-build power plants are unable to make successful bids.

Moreover, with the current capacity market system design, it is not really possible for variable power supply facilities such as solar and wind power to be counted on the market. On the other hand, just as an example, the Fifth Basic Energy Plan, revised last year, states that renewables should “become a main power supply source.” In addition, Japan is also attempting to achieve a non-fossil-fuel power supply ratio of 44% by 2030. According to the Long-term Energy Demand Outlook, the breakdown of this 44% is 20 to 22% nuclear power and 22 to 24% renewables, but it is already clear at the present time that the target for nuclear power is unattainable. How are these targets to be made consistent with what is happening on the capacity market?

In the first place, the vast majority of the power plants are owned by the FGPCs. These power plants, having a high public nature, were sited, constructed and operated under the Fully Distributed Cost (FDC) Method; i.e. the citizens of the country bore the various costs involved through public utility charges. Just because these power supply facilities have been deregulated, does that mean the FGPCs can do what they like with them?

It is pointed out as a reason for the introduction of the capacity market that, if the wholesale electricity market price converges on the SRMC, there will occur risks such as a) the possibility that initial investments cannot be recovered, b) power supply shortages resulting in the wholesale electricity market price trending to high levels over considerable periods of time, and c) price spikes (sudden extreme rises in price). However, despite there being sufficient capacity actually available, the wholesale electricity market price rose sharply in the winter and summer of 2018. This was partly the result of unplanned outages due to accidents, but another important factor was the shortage of power supply capability due to restrictions on the amounts of electricity generated over and above that necessary to fulfill demands on companies because of FGPC fuel constraints (suppression of fuel consumption).

Summary

The Ministry of Economy, Trade and Industry and OCCTO are claiming that the capacity market is price neutral. When electricity is transacted only on the wholesale electricity market, in the case of capacity shortages there is the possibility of sharp price rises and the continuation of high price levels, but these situations can be avoided by securing capacity through the capacity market. However, there are also risks involved in the introduction of a mammoth official market such as the capacity market. This kind of market is prone to regulatory blunders, and with the current market design it is mainly decrepit and dangerous nuclear power plants along with CO2-belching coal-fired power plants for which the capacity price will be recognized. It may also be that this market will make it difficult to construct new power stations.

We are now living in a transition period to a new electric power system marked by the introduction of large volumes of renewables, demand reduction and the shutdown of nuclear power plants. The introduction of a system, the capacity market, that gives strong incentives in the direction of locking in the status quo will lead to an obstruction of reforms. One reason for Germany adopting a “strategic reserve capacity” rather than a capacity market can be found here. Moreover, Japan constructed its electric power system on the exceptional recognition of regional monopoly to power companies in respect of the public nature of electricity and by placing the financial burden on the citizens of the country. It is important that policies to secure capacity be considered with these factors in mind.

Even if the capacity market is introduced, there are some approaches that need to be considered. Examples are that power supply facilities constructed under the FDC Method and for which investment has to some extent been recovered should be put to the maximum effective use (excepting nuclear power plants), and that the capability for predicting required capacity should be raised by encouraging the changeover of generations of power supply facilities by mandating decommissioning after a certain number of years.

The securing of capacity is necessary, but not at the expense of introducing a system that locks in the status quo for the foreseeable future. The introduction of the capacity market, even if it should go ahead, requires a fair system and full understanding by the citizens of the country. A more careful and well-thought-out consideration of the issues involved is demanded.