Envisioning a Future without Nuclear Power

By Matsukubo Hajime, Secretary General, CNIC

Happy New Year to all our readers! We wish to express our sincere gratitude for your understanding and cooperation in the activities of the Citizens’ Nuclear Information Center during the past year, and we ask for your continued support and cooperation in the coming year.

Looking back on 2024, two reactors were restarted, Onagawa Unit 2 in November and Shimane Unit 2 in December, bringing the total number of restarts in Japan to 14 (13.253 MW). There have been 24 nuclear power plants (NPPs) decommissioned (17.423 MW, including Tokai and Hamaoka Unit 1 and Unit 2), with no others added last year. Nine reactors have been undergoing inspections to meet the new standards (9.521 MW, including Ohma NPP, which is under construction, and Shimane Unit 3). Three reactors have passed these inspections (3.812 MW), and one has failed (1.16 MW, Tsuruga Unit 2). Applications have not yet been filed for another nine reactors (9.63 MW, including Tokyo Electric Power Co.’s (TEPCO’s) Higashidori Nuclear Power Station).

Trends in Reactor Restarts

No NPP restarts are expected in 2025. Faulty construction of a seawall came to light in October 2023 at Japan Atomic Power Co.’s (JAPC’s) Tokai 2 NPP, which had passed its inspection, so its completion date has been postponed from August 2024 to December 2026.

Regarding Kashiwazaki-Kariwa Units 6 and 7, the order prohibiting the transport of nuclear fuel that had been issued in April 2021 was lifted in December 2023. TEPCO reported that fuel loading was conducted at Unit 7 in April 2024 and will be conducted at Unit 6 in June 2025. In addition, transportation of spent fuel from Unit 7 to Unit 3 (380 assemblies, during FY 2024) and transportation of fuel to the interim storage facility operated by Recyclable-Fuel Storage Co. in Mutsu City, Aomori Prefecture, were conducted (September 24-26, 69 assemblies and one cask from Unit 4). Mayor Sakurai Masahiro of Kashiwazaki City imposed a condition of 80% or less of spent fuel storage capacity filled in general at the Unit 6 and Unit 7 reactors before he would agree to their restarts, so the transference between units was carried out to fulfil that condition.

At the same time, a signature drive was underway in Niigata Prefecture (until December 28) requesting that a prefectural voting ordinance on restarting NPPs be established. In August, Governor Hanazumi Hideyo of Niigata Prefecture said he would make the decision whether or not to consent to the restart of the reactors before the gubernatorial election at the expiration of his second term in June 2026 at the latest. In other words, it can be said that they will not be restarted until then.

No other reactors are set to be restarted for the time being. Progress is being made, however, in the inspections of other NPPs such as Tomari and Hamaoka, and thus we need to keep an eye on these.

Trends regarding Spent Fuel

Regarding the issue of spent fuel, as mentioned above, the biggest move in FY2024 was the commencement of operation of recyclable fuel storage facilities in Mutsu City, Aomori Prefecture. Kansai Electric Power Co. (Kanden) has been planning an interim storage facility in Kaminoseki Town, Yamaguchi Prefecture with Chugoku Electric Power Co., where they conducted a geological (boring) survey in April to November. Also, in conjunction with a spent-MOX-fuel reprocessing demonstration study announced by the Federation of Electric Power Companies (FEPC) in 2023, Kanden plans to ship 190 tons of spent fuel and 10 tons of spent MOX fuel from the Takahama NPP to Orano in France between 2027 and 2029. The spent fuel storage facilities at the Takahama NPP would be full by 2027, making it impossible to operate the NPP past then, so these shipments can be considered a de facto spent fuel countermeasure.

Progress was also made in 2024 regarding final disposal. Literature reviews were completed in Kamoenai Village and Suttsu Town, Hokkaido, and reports were published. Briefing sessions will be held in Hokkaido and other places in 2025, and a literature review will be conducted in Genkai Town, Saga Prefecture starting from June.

The General Election and Nuclear Power

Energy policy, unfortunately, was not a major point of dispute in the October 2024 general election in Japan. When analyzing the responses by winning candidates to questionnaire surveys of the candidates conducted by several of Japan’s media companies, however, an interesting state of affairs emerged.

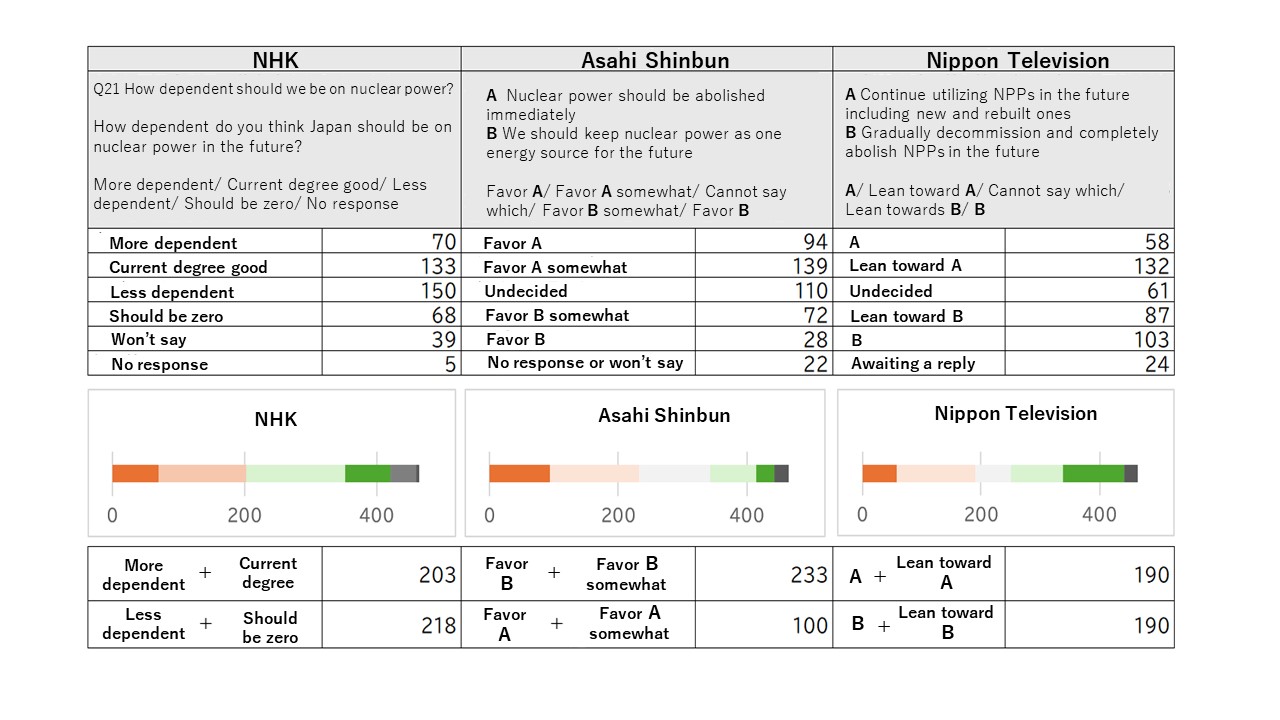

We analyzed the, Asahi Shimbun, and Nippon Television survey results, and from the results of NHK’s survey, for example, it was seen that among the winning candidates, more respondents expressed a desire to reduce or eliminate Japan’s dependence on nuclear power than to maintain the status quo or increase dependence on it. What was unclear, however, was whether the “status quo” referred to was the 9 percent dependence in FY 2023 or the 20 to 22 percent target for 2030. What is also interesting is that while Asahi Shimbun and Nippon Television asked similar questions, the responses elicited differed significantly depending on whether candidates were asked if nuclear power should be abolished “now” or totally eliminated “in the future.”

We analyzed the, Asahi Shimbun, and Nippon Television survey results, and from the results of NHK’s survey, for example, it was seen that among the winning candidates, more respondents expressed a desire to reduce or eliminate Japan’s dependence on nuclear power than to maintain the status quo or increase dependence on it. What was unclear, however, was whether the “status quo” referred to was the 9 percent dependence in FY 2023 or the 20 to 22 percent target for 2030. What is also interesting is that while Asahi Shimbun and Nippon Television asked similar questions, the responses elicited differed significantly depending on whether candidates were asked if nuclear power should be abolished “now” or totally eliminated “in the future.”

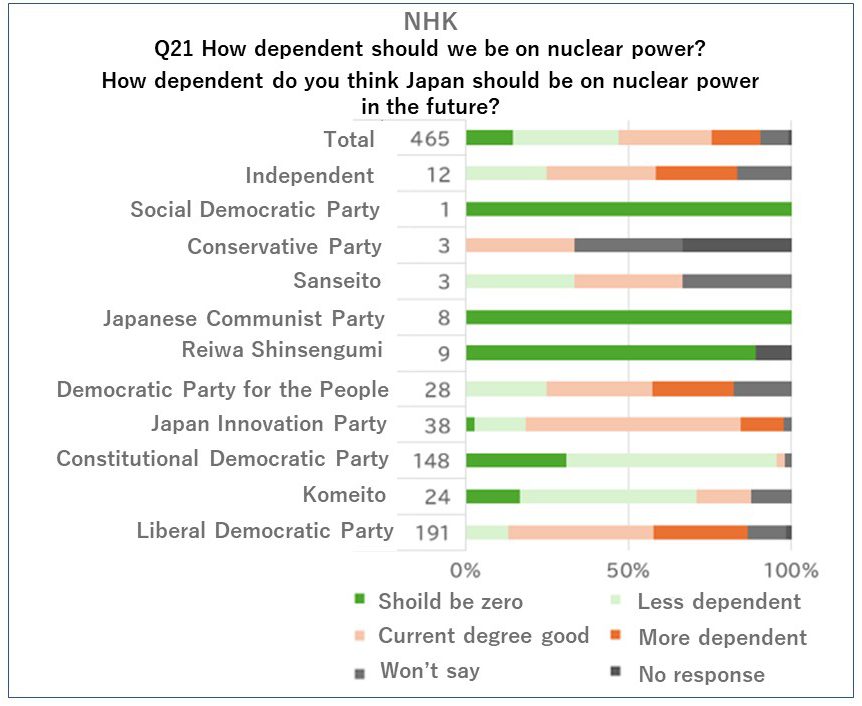

To sum up the responses to NHK’s and Nippon Television’s surveys, half of the respondents favored the reduction or elimination of nuclear power. Responses by political party were also shown (only for NHK’s, which had more space assigned to the story). Significant differences in tendencies can be seen between the Liberal Democratic Party (LDP) and Komeito Party regarding nuclear policy. Komeito’s responses tended to be similar to those of the Constitutional Democratic Party.

While is not true to say that the views of individual lawmakers are directly reflected in policy, these results suggest that the current course of active nuclear promotion lacks the backing to proceed very far. We need to provide compelling information to support those opposing nuclear power.

7th Strategic Energy Plan

The Kishida administration took the helm with its policy of active nuclear power promotion under the name of GX (Green Transformation). “GX” is a coined term that means “transforming the structure of industry and society from one that has been centered on fossil energy since the Industrial Revolution to one centered on clean energy.” What is particularly significant in this initiative is the choice to exclude the period during which Japan’s NPPs were shut down after the Fukushima nuclear accident in calculating their operating periods. Under Japan’s laws, the operating period of NPPs was set at 40 years, or in exceptional cases, 60 years, after which they were to be decommissioned. However, due to this debasement of that policy, the operating period of many NPPs has been extended by more than 10 years.

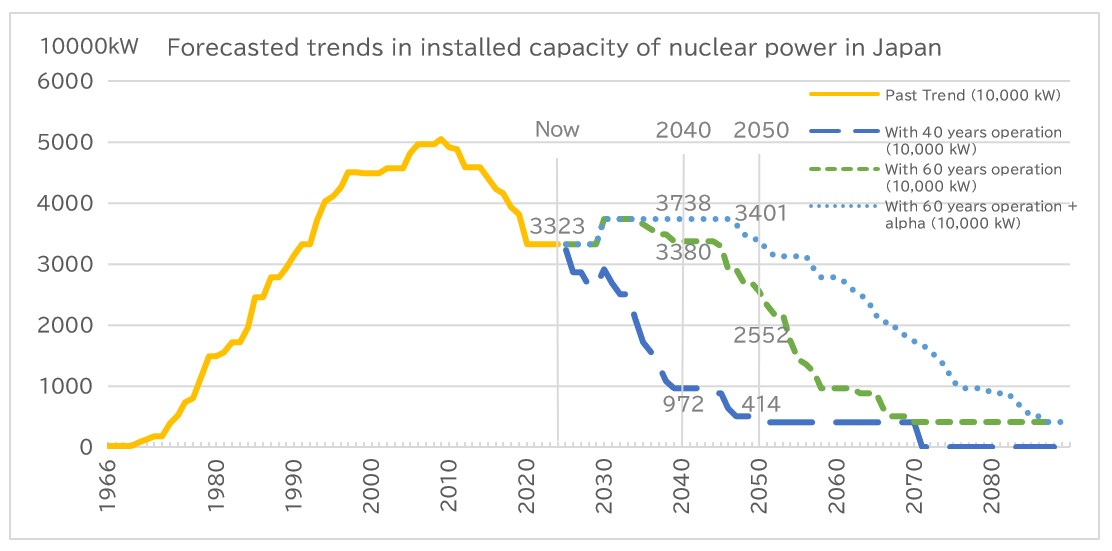

On the other hand, in a discussion by the Subcommittee on Nuclear Power in the 7th Strategic Energy Plan, in which the author participated, the assumption was made that the operating period of NPPs is 60 years, but they would be decommissioned in the future and the installed capacity would thereby decrease. In response, several members expressed the view that new NPPs would need to be built to maintain installed capacity. The Ministry of Economy, Trade and Industry (METI), however, had not brought up how extending the periods of operation of these plants by the length of time they had been idled would affect installed capacity. Therefore we estimated the effects such an extension would have on installed capacity (assuming the “60 years of operation + alpha” scenario: that all NPPs that were not being decommissioned and were still idled would be restarted by the end of 2028, and that the Ohma and Shimane-3 NPPs and TEPCO’s Higashidori plant, which are under construction, would begin operating in 2030). If the NPPs not being decommissioned have their operating periods extended by the amount of time they were shut down, the installed capacity would be greater than at present and continue to exceed that capacity until at least 2050. Thus, if new NPPs are built as METI has insisted, the current installed capacity would be exceeded.

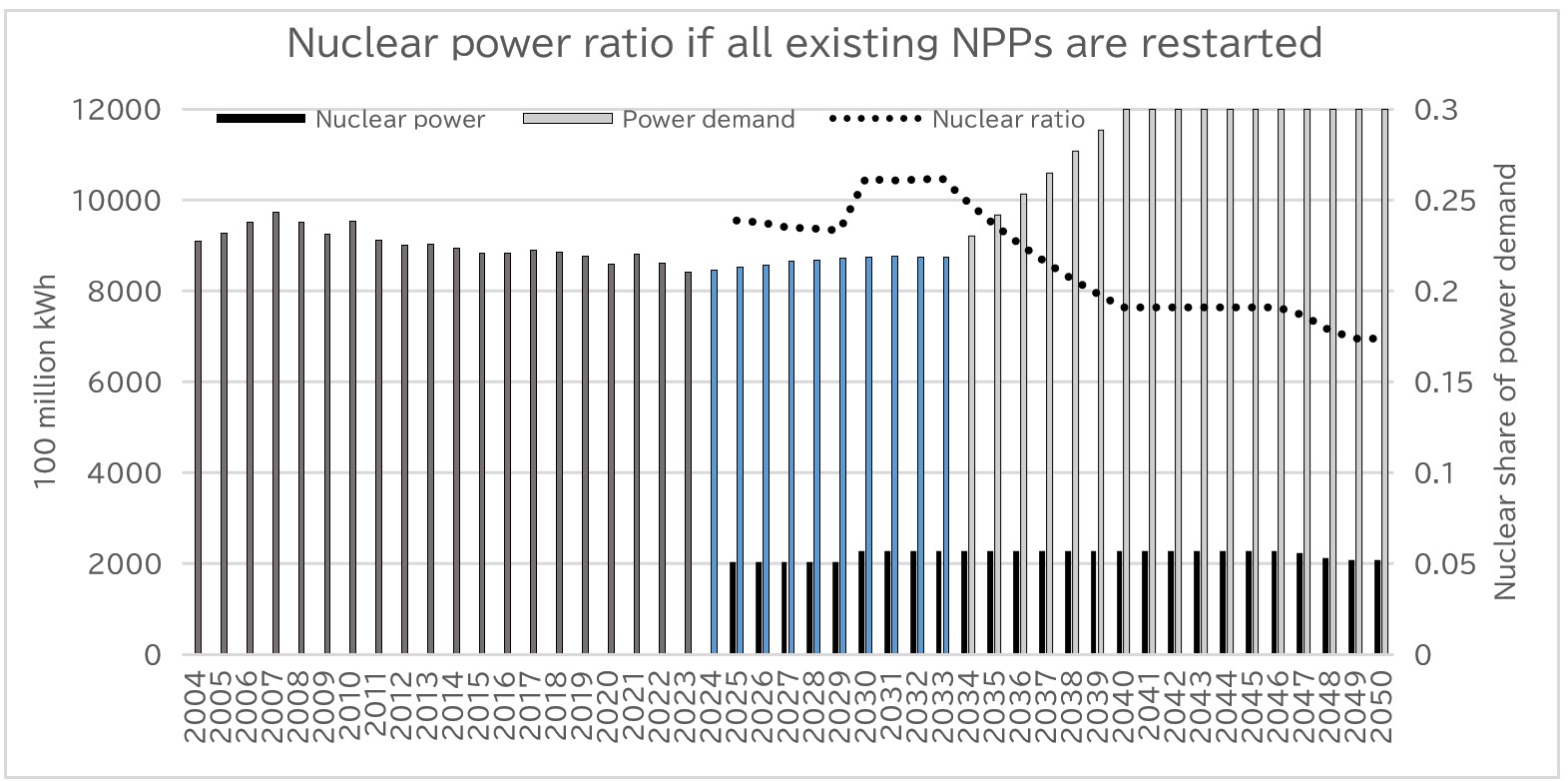

In addition, we estimated what would happen to the nuclear power ratio in the future, which is expected to be about 20 to 22 percent in 2030 under the current basic energy plan (the premise being the Organization for Cross-regional Coordination of Transmission Operators’ (OCCTO’s) electricity demand estimate through 2033, and assuming 1 trillion kWh by 2040, and 1.2 trillion kWh by 2050, during which growth is linear, with NPPs’ facility utilization rate of 70% under the “60 years of operation + alpha” scenario). We thus found that assuming all of Japan’s NPPs could be restarted, the nuclear power ratio would remain at the 20% level from 2030 to 2039.

The claim that new NPPs are needed to meet electricity demand is obviously wrong. It can be said that the information METI provided was intended to elicit a mistaken conclusion by the subcommittee.

The Basic Policy for the Realization of GX, approved by Japan’s Cabinet in 2023, is expected to lead to operation of the next-generation light water reactors starting in the latter half of the 2030s. If we assume an operating period of 60 years for these, they will be operational until the late 2090s. It’s worth noting that at a side event at the 28th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP28) held in December 2023, 23 countries, including the US, UK and Japan, announced a declaration to triple the world’s nuclear power capacity by 2050. The same declaration was adopted at COP 29 in November 2024, with the number of countries supporting it increasing to 31.

The Basic Policy for the Realization of GX, approved by Japan’s Cabinet in 2023, is expected to lead to operation of the next-generation light water reactors starting in the latter half of the 2030s. If we assume an operating period of 60 years for these, they will be operational until the late 2090s. It’s worth noting that at a side event at the 28th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP28) held in December 2023, 23 countries, including the US, UK and Japan, announced a declaration to triple the world’s nuclear power capacity by 2050. The same declaration was adopted at COP 29 in November 2024, with the number of countries supporting it increasing to 31.

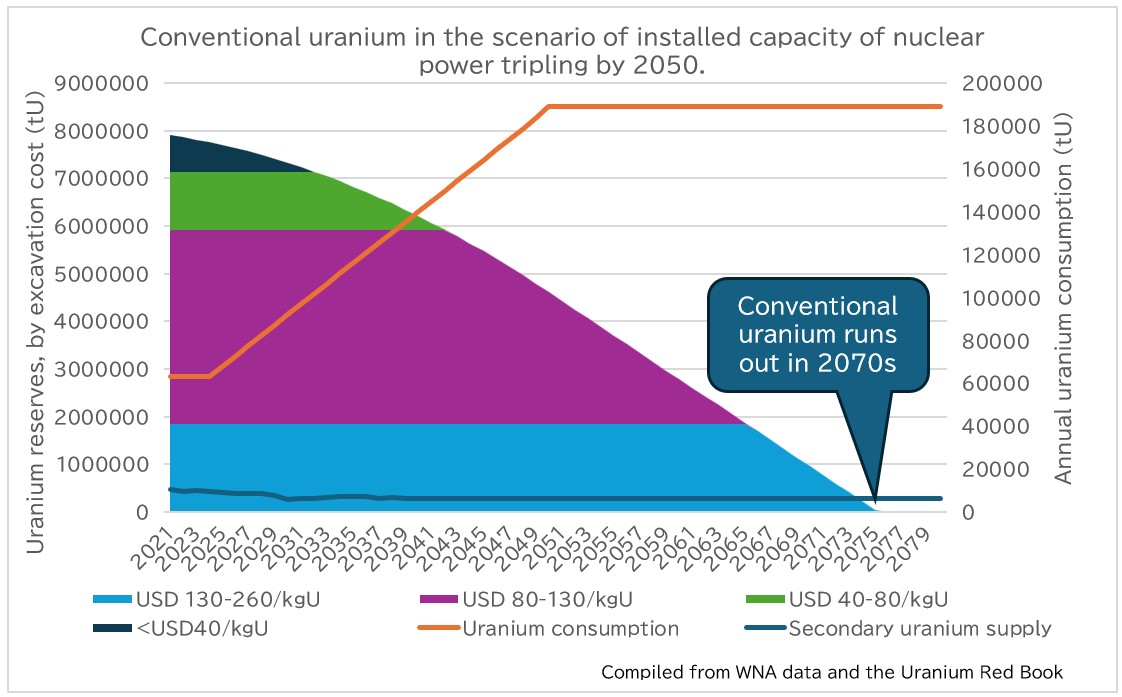

The fuel for nuclear power is uranium. Currently, uranium is obtained from conventional uranium mines, but the number of mines producing uranium at low cost in particular has been decreasing year by year (the amount of verified uranium reserves with an excavation cost of 40 US$ or less per ton declined from 2.05 million tons in 2001 to 770,000 tons in 2021). We therefore estimated the future uranium situation, given confirmed reserves of 7.92 million tons as of 2021, if this declaration to triple nuclear power is implemented (assumptions being that total installed capacity of 393 GW, annual uranium consumption of 63,000 tons, installed capacity tripling by 2050, during which growth is linear and second-order uranium supplies such as MOX are provided, based on World Atomic Energy Association data). The results showed conventional uranium running out in the 2070s. If the declaration to triple nuclear power is implemented, the fuel for the next-generation light water reactors will run out in the 2050s, right in the middle of their operational lives. If it happens that addition uranium is not located, there is a significant risk of losing a stable supply of fuel.

The Nuclear Power Subcommittee is seeking to have the nuclear operators support the costs related to maintaining their NPPs and building new ones. Nuclear power has become an energy source that cannot be built witout passing on the tab to citizens. Moreover, the rationale for building new NPPs is extremely unclear, and the fuel will run out in any case. Establishing new NPPs can now be said to be a case of the proverbial “hundred harms with not one benefit.”

* * *

Ban Hideyuki, who served as CNIC’s Co-Director for many years, passed away last June. Many people participated in the memorial meeting held in November, and we thank them all sincerely. It was a big blow for us to lose Mr. Ban. Still, all of our staff continue to work hard every day toward denuclearization.

This year marks the 50th anniversary of CNIC’s establishment. We thank you all for your continued support and cooperation.